Tax Bachao

Tax Bachao

INTRODUCTION

Don’t you want to save more of your hard earned money from taxes? It is simple!

When you save through Voluntary Pension Schemes (VPS) with MCB Funds, you get twin benefits of earning returns and reducing your taxes. Therefore, say goodbye to taxes and give more power to your savings.

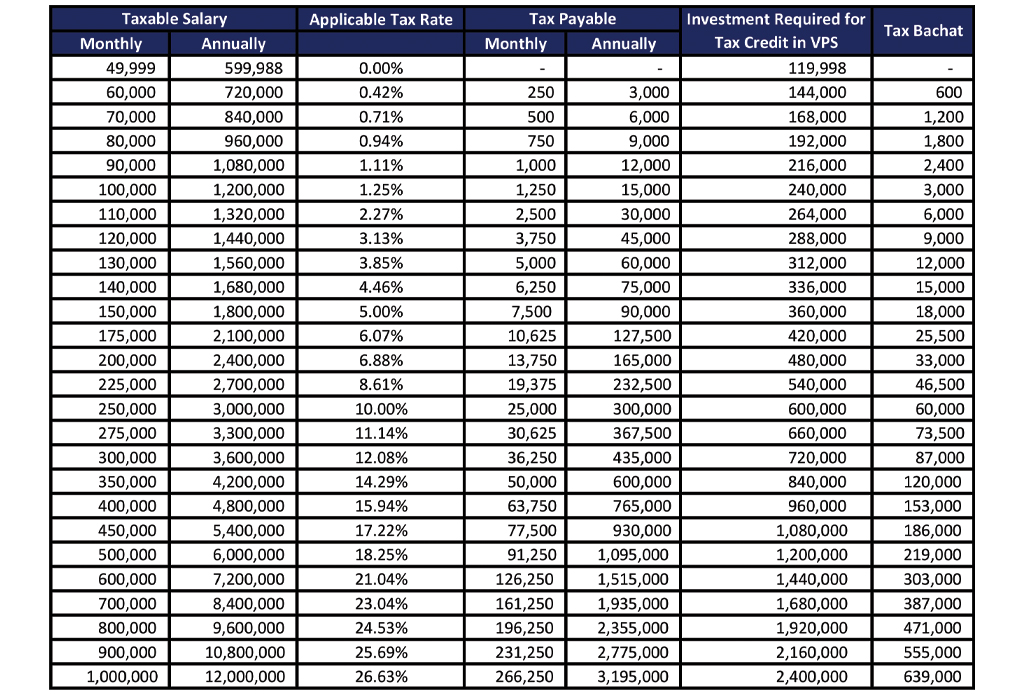

CALCULATE HOW MUCH YOU CAN SAVE ON YOUR TAXES!

HOW CAN I DO THIS?

STEP 1

CALL US AT “021-11-11-ISAVE (47283)” OR SMS TAX to 8622 TO SPEAK TO ONE OF OUR TAX ADVISORS

OR

YOU CAN ALSO VISIT iSAVE.MCBFUNDS.COM AND CREATE AN ACCOUNT ON iSAVE IN A FEW MINUTES.

STEP 2

For salaried individuals:

Inform your Human Resources (HR) or Finance Department about your investments and ask them to adjust your tax credit amount from the monthly income tax deductions made from your salary

For self-employed individuals or non-salaried individuals:

When filing your own personal income tax returns, you can adjust your tax payable and enclose a copy of your statement of investment along with your documents when you file your returns

Please note:

Note-1: According to Section 63 of the Income Tax Ordinance, 2001, an individual Pakistani who holds a valid CNIC/NICOP can claim tax credit at average rate of tax on investments made in voluntary pension schemes during the tax year up to twenty per cent (20%) of his/her taxable income for that tax year.

Tax credit amounts computed above are estimates based on individual drawing income from salary for a whole tax year. Tax liabilities may change based on a number of circumstances and we advise that you should consult with your tax advisor/ financial consultant for exact tax credit amounts based on your particular circumstances.

Disclaimer: All investments in voluntary pension schemes are subject to market risks. Past performance is not necessarily indicative of the future results. Please read the Offering Document to understand the investment policies and the risks involved. The tax credit information provided in this literature is based on interpretation of MCB Funds. Investors are advised to seek independent professional advice in this regard. Capital gain tax and withholding tax on dividend and bonus units will be charged according to Income Tax Laws, if applicable. Withdrawal from Voluntary Pension Schemes before retirement shall have tax implications.