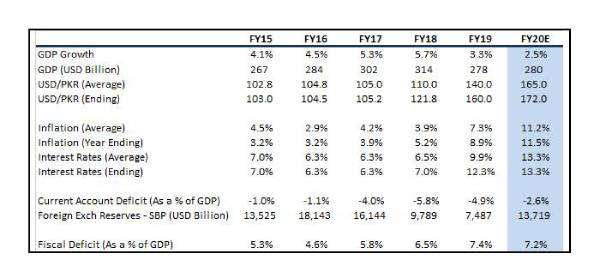

The bearish spell at Pakistan Stock Exchange continues unabated and has taken over the nerves of investors. The stock market is down by nearly ~45% from the peak level it witnessed in May’17 and currently is trading at its 5-year low. Certainly, we share the concern, as it has been nearly 800 days since KSE100 index formed its peak and we are yet to find the bottom. Even during the last financial crisis (FY09) which was one of its kind, it took only 283 days for the KSE100 Index to form a trough from its peak.

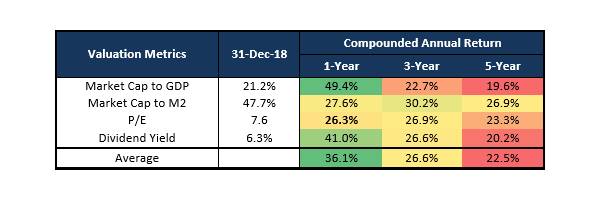

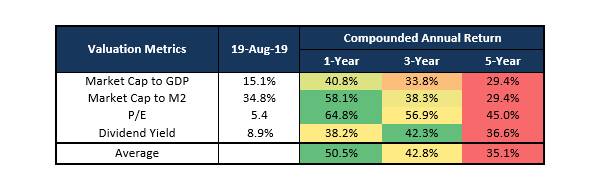

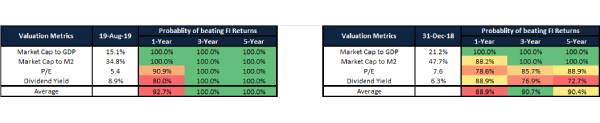

The legendary investor Warren Buffet points; “The stock market is a device for transferring money from the impatient to the patient.” Perhaps, this is the period to relate the famous phrase that markets can remain irrational for a period of time, and patience will remain a key virtue for successful investing for the long term investors. Back in December 2018, we presented a strategy report, where we highlighted that market has the potential to produce double digit returns exceeding 15% for the next year. Our premise was based on the fact that valuations have priced in most of the negatives, therefore, stock market should have formed the bottom. We presented a table with major valuation indicators and provided how average returns fared based on those indicators based on history. To make it easy for our audience, we will read out a sample from the table. Based on the table provided below, the Price to Earnings ratio on the last date of calendar year 2018 was 7.6 x, and based on the 20 years history, if an investor had invested in the market near such ratio, the expected 1-Year return would have been 26.3%.